Rethink Tomorrow with Northern Trust Wealth Management

On the Precipice of Great Change

The dawn of AI. Tax uncertainty, including sunsetting provisions set to cut estate tax exemptions by half. Quickly evolving social mores. In times of change, it is easy to become frozen by indecision.

Northern Trust’s 2024 Wealth Planning Outlook, Rethink Tomorrow, provides a forward-looking view on the most relevant wealth planning issues of the coming year — and actionable insights for your plan.

In the outlook, the experts of the Northern Trust Institute discuss navigating these changes by asking and answering three primary questions.

Rethink Thinking

How do we preserve a critical human perspective in our planning while taking advantage of the massive technological disruption and opportunity of AI?

Spurred in part by the release of ChatGPT in late 2022, the global conversation on, and massive investment in, AI has resulted in a profound rethinking of many human endeavors. Adoption has been rapid, with significant implications for wealth planning.

While the opportunities are massive across predictive analytics and client experience, individuals, advisors and businesses must also be mindful of the limitations of this powerful technology. Indeed, its capabilities only enhance the indispensable role of human judgment.

Rethink Planning

How can we apply lessons from the past amid an unpredictable tax landscape?

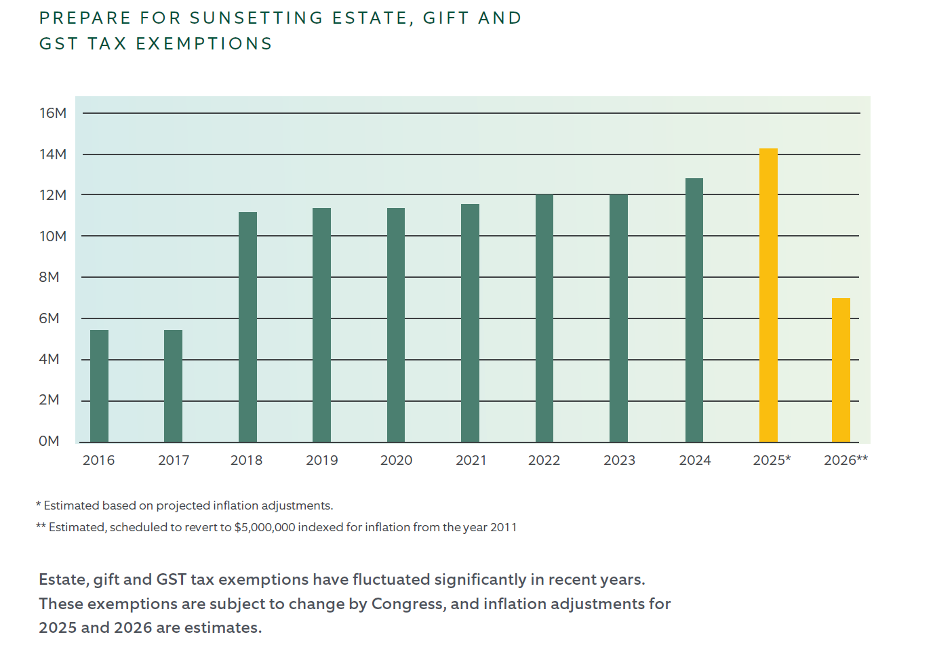

In uncertain times, it is far better to assess the current landscape and make informed decisions within the construct of a flexible plan than attempt to anticipate how and when Congress will change tax law. Of paramount importance to planning is the sunsetting provision in the estate, gift and GST tax exemption amounts. These exemptions have recently been at an all-time high but, barring action by Congress, are scheduled to revert to pre-2017 levels at the end of 2025.

Transferring appreciation out of your name during your lifetime can yield considerable tax savings but should be done thoughtfully. As recent history in similar scenarios has demonstrated, rushed planning can lead to significant mistakes — including over-gifting that results in a loss of sufficient liquidity in years to come.

Rethink Legacy

How do we best articulate and plan our legacies amid new thinking on what the greater meaning of legacy is — and new planning techniques designed to help you realize yours?

With a diminished focus on tax in light of historically high exemptions, many wealth creators have given greater reflection to the true meaning of legacy — and are increasingly seeking to foster the overall, not only financial, well-being of beneficiaries as the cornerstone of their planning.

In response, a number of new strategies are available to help create these new kinds of legacies. Purpose trusts, benefit corporations, entrepreneur’s trusts and shared philanthropy are increasingly used to promote a positive relationship between family wealth, family members and the broader community.

For actionable insights to evolve your plan for change, request the full outlook

© 2023 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S.

This information is not intended to be and should not be treated as legal advice, investment advice or tax advice and is for informational purposes only. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal or tax advice from their own counsel. All information discussed herein is current only as of the date appearing in this material and is subject to change at any time without notice.

Read Next

Navigator Newsletter Stay informed on all things yachting and luxury lifestyle with the bi-monthly Navigator newsletters.